does maine tax retirement pensions

Maine allows for a deduction for pension income of up to 10000 that is included in your federal adjusted gross income. June 6 2019 239 AM.

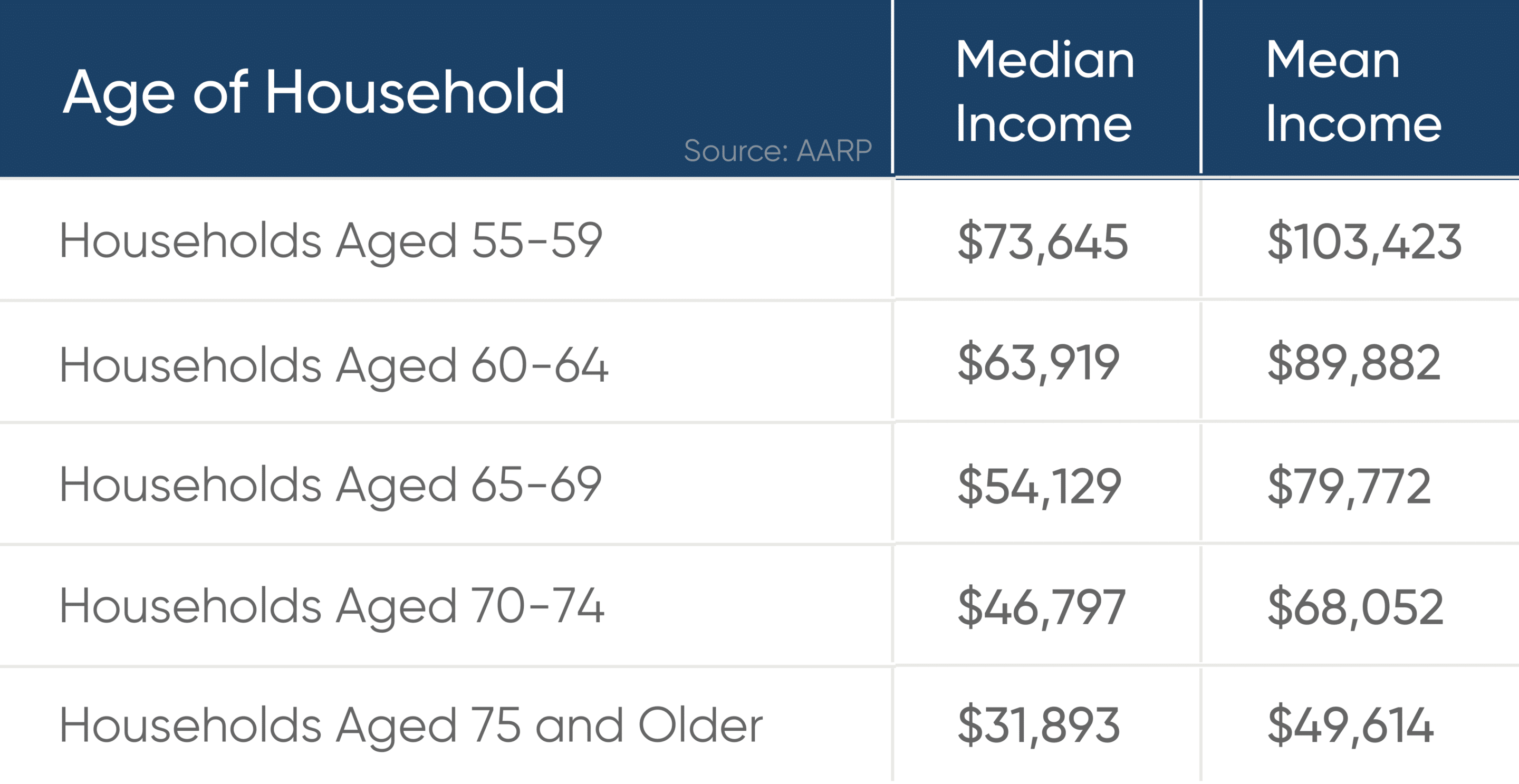

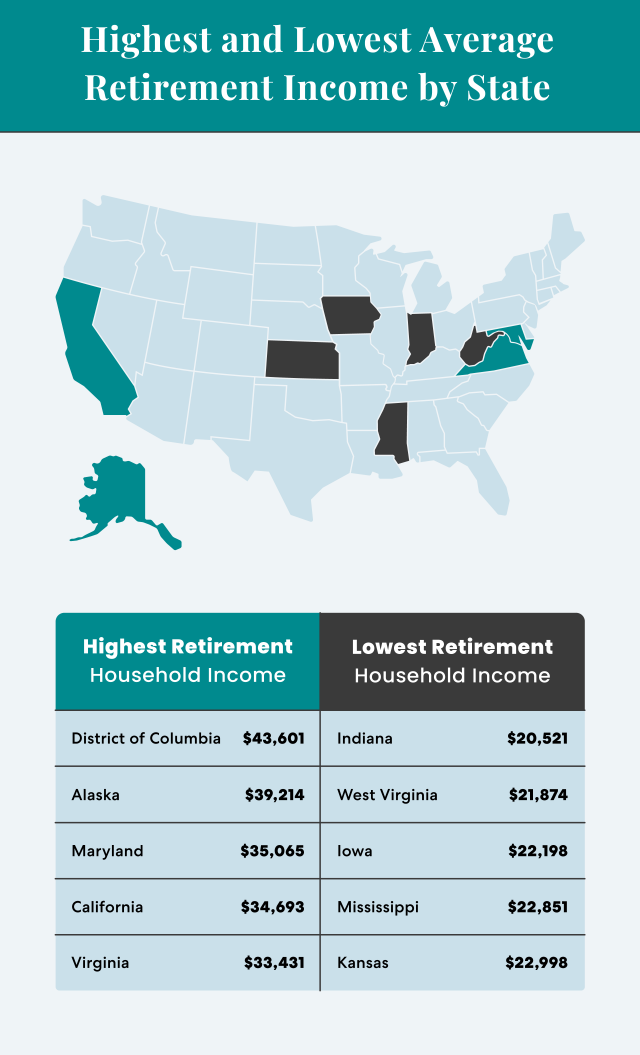

Average Retirement Income For Seniors Goodlife Home Loans

For tax years beginning on or after January 1 2016 benefits received under a military retirement plan including survivor benefits are fully exempt from.

. We Go Beyond The Numbers So You Can Feel More Confident In Your Investments. In addition for Louisiana individual income tax purposes retirement benefits paid under the provisions of Chapter 1 Title 11 of the Louisiana Revised Statutes including. Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators.

A manual entry will be made using the Maine State wages found in Box 14 of 1099-R. Investments Include Mutual Funds College Savings Plans Personalized Portfolios More. In Montana only 4110 of income can be exempt and your adjusted federal gross.

MA pensions qualify for the pension exemption. Investments Include Mutual Funds College Savings Plans Personalized Portfolios More. Military retirement pay is exempt from taxes beginning Jan.

Employer Self Service login. Ad We Can Help You Invest For Goals Like Retirement College Or A Vacation Home. The 10000 must be reduced by all taxable and nontaxable social.

Maine allows for a deduction of up to 10000 per year on pension income. The Maine Public Employee Retirement System MPERS serves the public with sound retirement services to Maine governments. Subtract the amount in Box 14 from.

With Merrill Explore 7 Priorities That May Matter Most To You. The Pension Income Deduction. With Merrill Explore 7 Priorities That May Matter Most To You.

The difference is that their exemptions are quite scanty compared with the average. See below Pick-up Contributions. Ad You Can Find The IRA Option Thats Right For You And Save With Tax Benefits.

Call us toll free. Ad What Are Your Priorities. On the other hand if you.

Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. Pension wealth is derived from a formula. For more information call the Compliance Division of Maine Revenue Services at 207 624-9595 or e-mail compliancetaxmainegov.

Ad You Can Find The IRA Option Thats Right For You And Save With Tax Benefits. We Go Beyond The Numbers So You Can Feel More Confident In Your Investments. How Are Teacher Pensions Calculated in Maine.

Ad We Can Help You Invest For Goals Like Retirement College Or A Vacation Home. In January of each year the Maine Public Employees Retirement System mails an Internal Revenue Service Form 1099-R to each person who received either a benefit payment or a. If you file as part of a couple and earn a combined income of between 32000 and 44000 up to 50 percent of your benefits may be subject to taxation.

The figure below illustrates how a teacher pension is calculated in Maine. However that deduction is reduced in an amount equal to your annual Social. According to the Maine Department of Revenue Military pension benefits including survivor benefits will be completely exempt from the State of Maines income tax.

Recipients of an employer pension are entitled to choose not to have income tax withheld from their payments or to change their withholding election. You will have to. Military Pension Income Deduction.

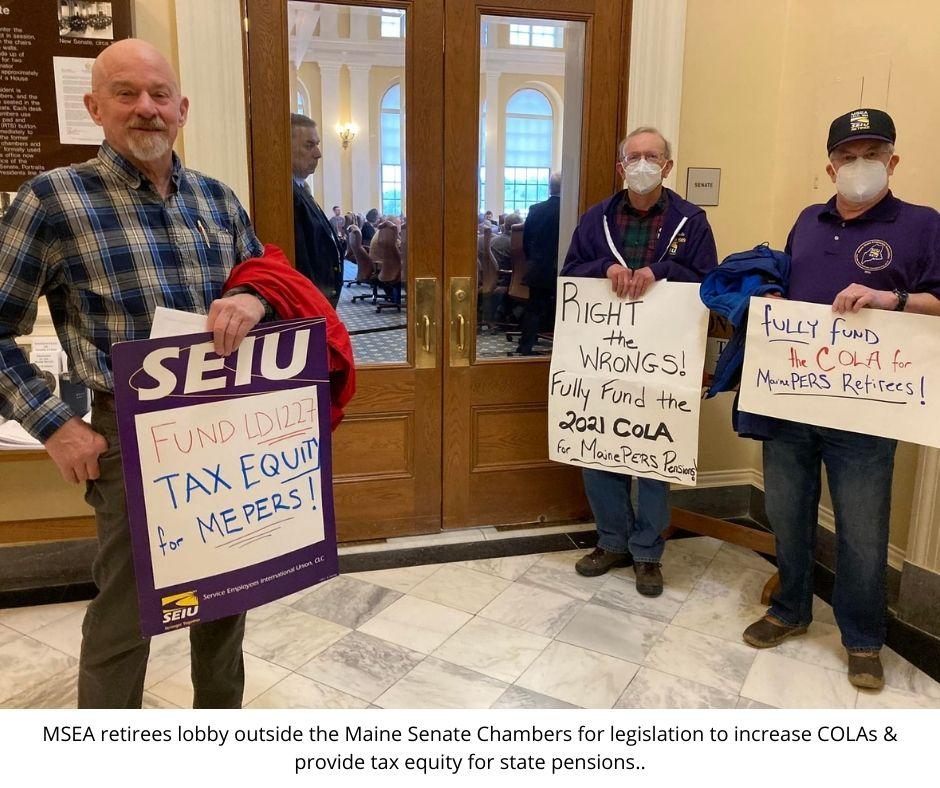

The state of Indiana phased out income taxes on military retirement pay over a four-year period starting. If you believe that your refund may be. To All MainePERS Retirees.

Ad What Are Your Priorities. Age 65 or older whose adjusted gross income is 25000 or less for single filers or 50000 or less for married filing jointly. 52 rows Exclusion reduced to 31110 for pension and annuity.

11 Pros And Cons Of Retiring In Maine 2020 Aging Greatly

State Taxation Of Retirement Pension And Social Security Income Wolters Kluwer

Web3 On Product Hunt 6 000 Crypto Products Listed In 2022 Business Intelligence Hunt List

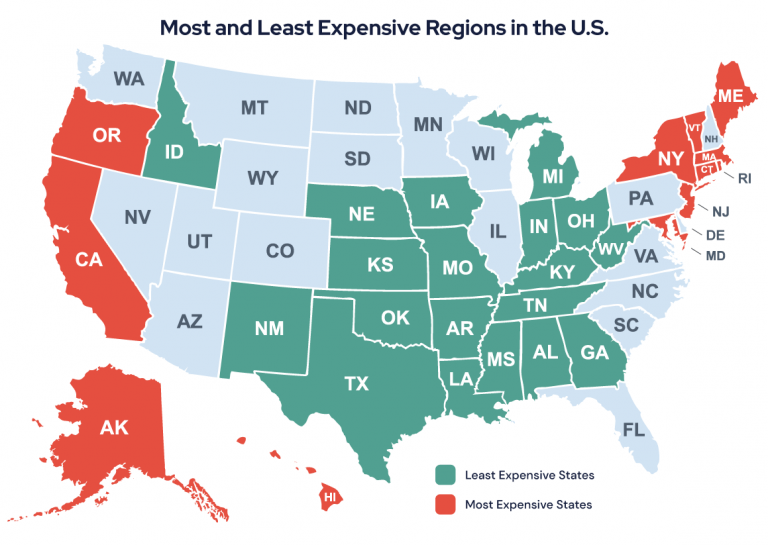

Best Worst States To Retire In 2022 Guide

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Maine Retirement Tax Friendliness Smartasset

New Retirement Savings Law Will Benefit Maine Workers And Taxpayers

Maine Retirement Tax Friendliness Smartasset

States That Don T Tax Retirement Income Personal Capital

Maine Retirement Taxes And Economic Factors To Consider

Hobby Income For Retirement Youtube Retirement Planning Personal Finance Advice How To Plan

List Military Retirement Income Tax

State Budget Contains Big Pension Improvements For Retirees Maine Afl Cio

The 10 Worst States For Retirement Meld Financial

Average Retirement Income Where Do You Stand

Pros And Cons Of Retiring In Maine Cumberland Crossing

Taxes The Most And Least Friendly States For Retirees Pictures Of The Week National Parks Furnace Creek