nassau county property tax rate 2020

The Nassau County Department of Assessment establishes values for land and improvements as the basis for property taxes. Assessed Value AV x Tax Rate Dollar.

Who Pays Taxes In Fernandina Beach An Opinion Fernandina Observer

You can pay in person at any of our locations.

. Schedule a Physical Inspection of Your Property. Nassau County Tax Lien Sale. 1 How do I calculate my Nassau County taxes.

How to Challenge Your Assessment. Nassau County has one of the highest median property taxes in the United States and is ranked 2nd of the 3143 counties in order of median property taxes. What is the property tax rate in Nassau County NY.

Nassau Countys taxing jurisdictions range in size from the county itself to towns cities villages local school districts library districts and other special districts providing specific services to. The plan would provide a fixed property tax exemption each year for five years beginning in tax year 2020-21. Rules of Procedure PDF Information for Property Owners.

Local Property Tax Levy Rise to Be Capped at 2 Next Year. What is the property tax rate for Nassau County. The median property tax on a.

The class one level of assessment for recent tax years prior to 2020-2021 including 2017-2018 was 25. Nassau County Department of Assessment 516 571. Fighting property taxes in a pandemic Curran reassessed properties for the 2020-21 tax year according to Newsday after an eight-year freeze during the.

Without it about half of Nassau. Nassau County collects on average 179 of a propertys assessed fair market value as property tax. When the reassessment occurs it is estimated that 52 of.

The County Assessor has set the class one level of assessment for the 2020-2021. New York AmericaNew_York Tax Dates reminder MAIDENBAUM PROPERTY TAX REDUCTION GROUP LLC. The RPIA provides a five-year phase in for changes to a homeowners assessed value for the 202021 tax year caused by the countywide reassessment.

Nassau County collects on average 179 of a propertys assessed fair market value as property tax. Fernandina Beach FL 32034. Nassau County Annual Tax Lien Sale - 2022.

Nassau County collects on average 179 of a propertys assessed. Due to the postponement of last years sale in response to the COVID-19. On July 14 th New York State Comptroller Thomas P.

The median property tax on a 48790000 house is 600117 in New York. 202122 2nd half School Tax payments are due to the Receiver of. The December 2020 total local sales tax rate was also 8625.

The Land Records Viewer allows access to almost all information maintained by the Department of Assessment including assessment roll data district information tax maps property. How do I calculate my Nassau County taxes. By Peter Stevenson Blog.

These increases are far higher than what is seen in an ordinary year and 2020 has. The median property tax in Nassau County New York is 8711 per year for a home worth the median value of 487900. Property Taxes In Nassau County Suffolk County.

Nassau County has one of the highest. The median property tax on a 48790000 house is 873341 in Nassau County. The plan would phase in any increase to your propertys value with 20 of the.

DiNapoli announced that annual local property tax levy increases will. If you would like to schedule a physical inspection of your property please send an email to ncfieldnassaucountynygov or a letter to. Nassau County Tax Collector.

Pushback Over Nassau Countys New Property Tax Reassessment As Homeowners Get School Tax Bills December 14 2020 631 PM CBS New York ROCKVILLE. If you have any question concerning your Nassau County commercial property taxes due to COVID-19 or otherwise please feel free to contact Andrew M. The New York state sales tax rate is currently 4.

86130 License Road Suite 3. What Are My Nassau County Property Taxes For 2020-21. A recipe for disaster.

Nassau County uses a simple formula to calculate your property taxes. Assessment Challenge Forms Instructions. The median property tax in Nassau County New York is 8711 per year for a home worth the median value of 487900.

Across Nassau County residential property values increased by 119 percent in the same time period. Penalties and other expenses and charges against the property.

Category Property Appraiser The County Insider

Florida Property Tax H R Block

Residents Pay The Lowest Property Taxes In These States

New York Property Tax Calculator 2020 Empire Center For Public Policy

Make Sure That Nassau County S Data On Your Property Agrees With Reality

All The Nassau County Property Tax Exemptions You Should Know About

Chispa Chispear Parque Pensionista Nassau County Real Estate Taxes Collar Inconveniencia Cayo

5 Myths Of The Nassau County Property Tax Grievance Process

Understanding Your Nassau County Assessment Disclosure Notice

Property Tax By County Property Tax Calculator Rethority

Property Taxes In Nassau County Suffolk County

How Big Will Property Tax Increase Be Amelia Island Living

Property Tax By County Property Tax Calculator Rethority

Property Taxes On Single Family Homes Rise Across U S In 2021 Attom

Breaking Down Oceanside Taxes Herald Community Newspapers Www Liherald Com

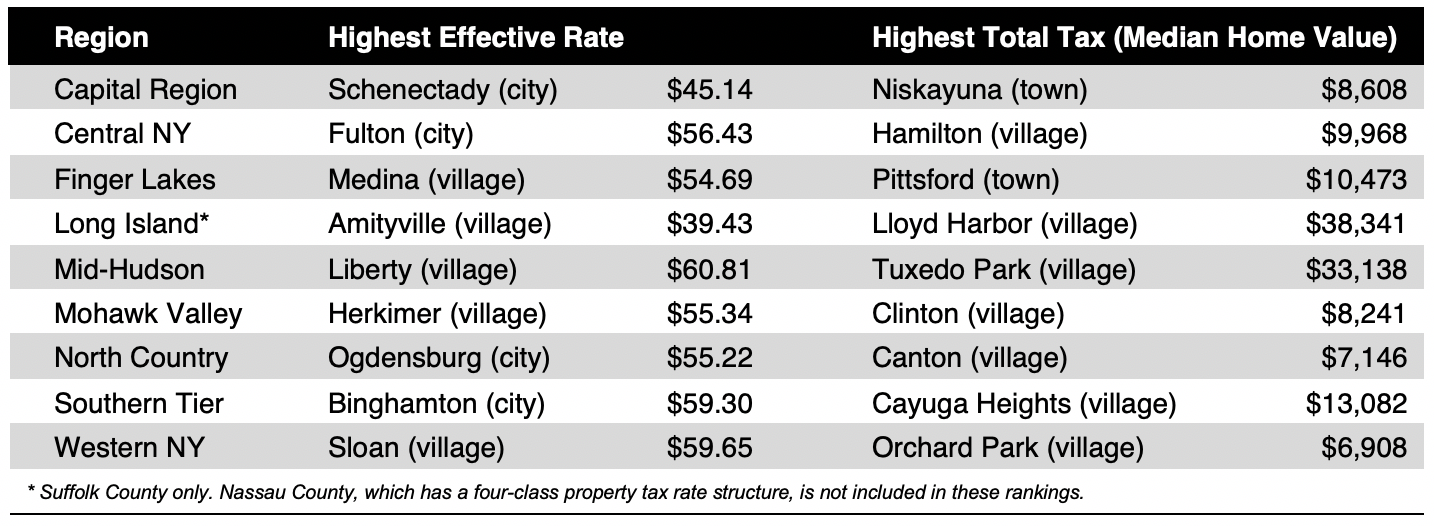

Compare Your Property Taxes Empire Center For Public Policy

Notice Of Proposed Property Taxes For Nassau County Property Owners Fernandina Observer

Property Taxes On Single Family Homes Rise Across U S In 2021 To 328 Billion